All Categories

Featured

Table of Contents

On the various other hand, if a customer requires to offer an unique demands child who may not have the ability to manage their own money, a count on can be included as a beneficiary, permitting the trustee to take care of the circulations. The kind of recipient an annuity proprietor chooses impacts what the recipient can do with their acquired annuity and how the earnings will be strained.

Several agreements allow a spouse to identify what to do with the annuity after the proprietor dies. A partner can alter the annuity agreement right into their name, assuming all guidelines and rights to the first agreement and postponing prompt tax effects (Deferred annuities). They can collect all remaining repayments and any type of survivor benefit and choose recipients

When a partner becomes the annuitant, the partner takes over the stream of settlements. This is called a spousal extension. This clause enables the making it through partner to maintain a tax-deferred standing and safe and secure long-term monetary stability. Joint and survivor annuities additionally permit a called recipient to take control of the agreement in a stream of settlements, instead of a round figure.

A non-spouse can only access the marked funds from the annuity owner's initial contract. In estate preparation, a "non-designated recipient" refers to a non-person entity that can still be named a recipient. These consist of depends on, charities and other organizations. Annuity proprietors can pick to designate a count on as their beneficiary.

What does an Annuities include?

These differences mark which beneficiary will obtain the whole survivor benefit. If the annuity owner or annuitant dies and the primary recipient is still to life, the main beneficiary obtains the survivor benefit. If the main beneficiary predeceases the annuity owner or annuitant, the fatality benefit will certainly go to the contingent annuitant when the owner or annuitant dies.

The proprietor can transform recipients at any type of time, as long as the contract does not call for an irrevocable beneficiary to be called. According to expert contributor, Aamir M. Chalisa, "it is very important to recognize the value of designating a recipient, as choosing the wrong beneficiary can have serious repercussions. A number of our clients select to name their minor kids as recipients, frequently as the primary beneficiaries in the lack of a spouse.

Owners that are wed ought to not assume their annuity instantly passes to their partner. When picking a recipient, take into consideration variables such as your connection with the person, their age and how acquiring your annuity may affect their economic situation.

The recipient's connection to the annuitant normally identifies the guidelines they comply with. For instance, a spousal recipient has more alternatives for taking care of an acquired annuity and is dealt with more leniently with taxes than a non-spouse beneficiary, such as a youngster or various other member of the family. Annuity income. Expect the owner does make a decision to call a kid or grandchild as a beneficiary to their annuity

How do I apply for an Tax-efficient Annuities?

In estate planning, a per stirpes designation specifies that, needs to your beneficiary die before you do, the recipient's offspring (kids, grandchildren, et cetera) will certainly get the death benefit. Link with an annuity specialist. After you've picked and called your recipient or recipients, you should remain to examine your choices at least annually.

Maintaining your classifications up to day can guarantee that your annuity will certainly be taken care of according to your desires need to you pass away unexpectedly. An annual evaluation, significant life events can trigger annuity owners to take another look at their recipient options.

What is included in an Deferred Annuities contract?

Similar to any kind of economic product, looking for the assistance of a financial expert can be helpful. A monetary organizer can guide you via annuity management processes, consisting of the approaches for updating your contract's beneficiary. If no beneficiary is named, the payout of an annuity's survivor benefit mosts likely to the estate of the annuity holder.

To make Wealthtender totally free for visitors, we make cash from marketers, including financial specialists and firms that pay to be included. This develops a problem of rate of interest when we favor their promotion over others. Wealthtender is not a client of these financial services service providers.

As a writer, it's one of the finest praises you can give me. And though I actually value any of you spending some of your busy days reading what I compose, clapping for my short article, and/or leaving praise in a comment, asking me to cover a topic for you really makes my day.

It's you saying you trust me to cover a topic that's vital for you, which you're positive I would certainly do so better than what you can currently locate online. Pretty spirituous stuff, and an obligation I don't take likely. If I'm not acquainted with the subject, I research it on-line and/or with calls that know more about it than I do.

Annuity Interest Rates

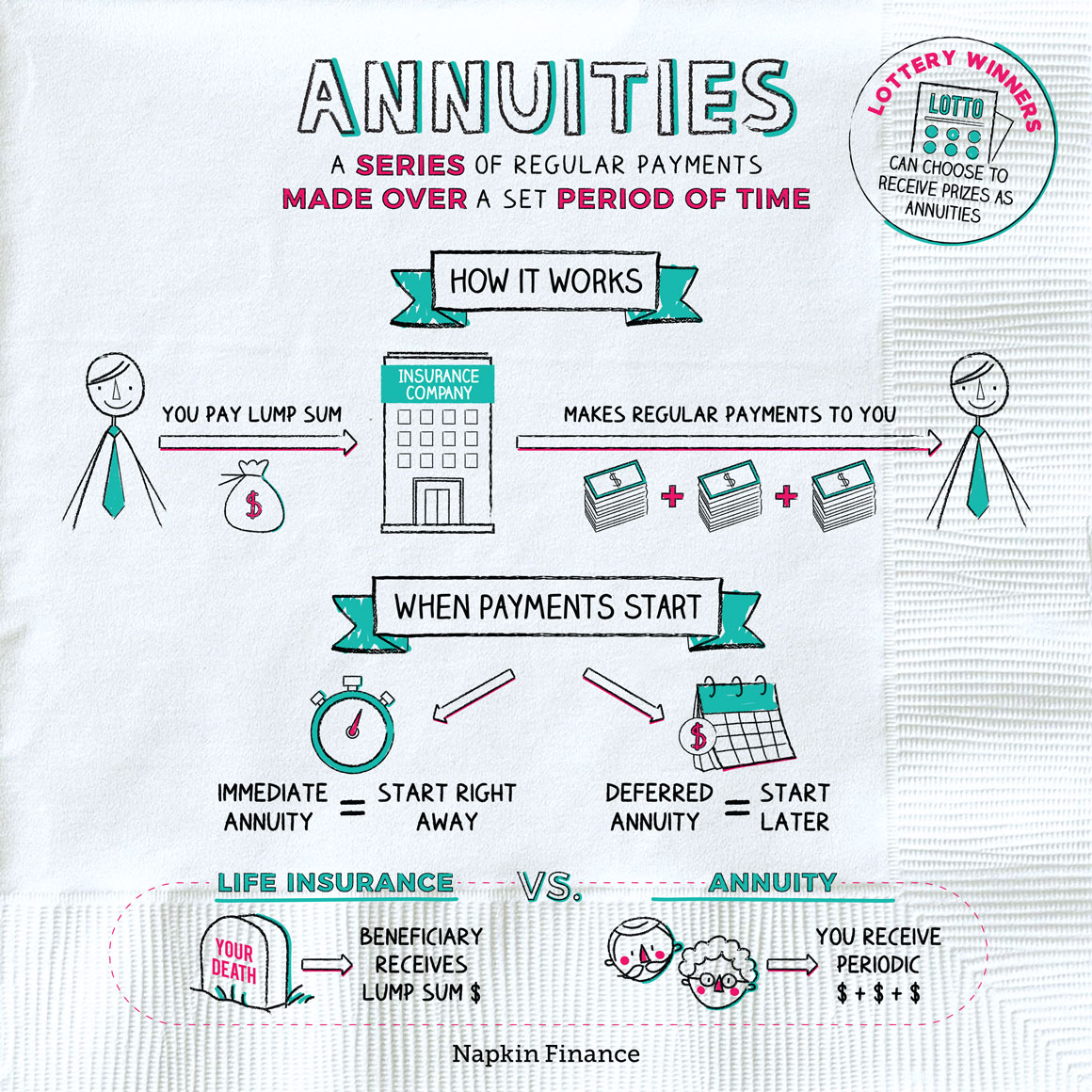

Are annuities a legitimate recommendation, an intelligent step to protect surefire earnings for life? In the simplest terms, an annuity is an insurance product (that only certified representatives may offer) that assures you monthly payments.

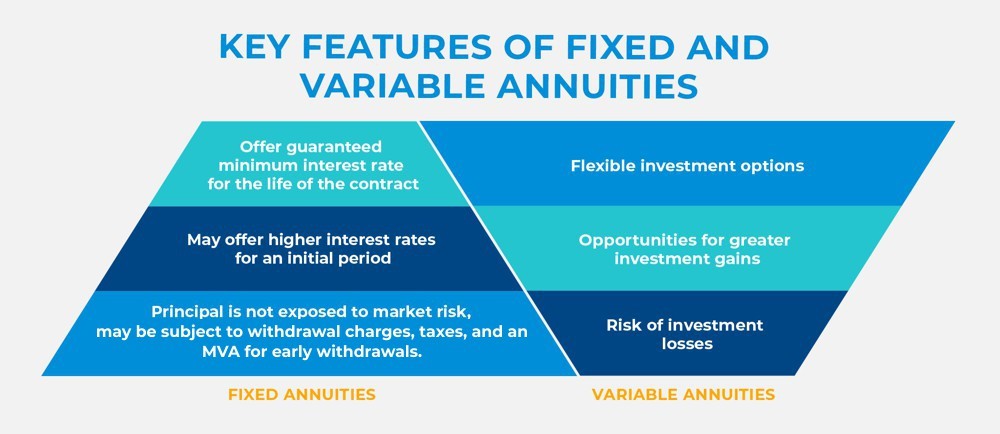

This typically uses to variable annuities. The even more riders you tack on, and the less danger you're prepared to take, the lower the settlements you ought to anticipate to obtain for a given costs.

How can an Annuity Contracts help me with estate planning?

Annuities chose correctly are the appropriate selection for some individuals in some circumstances., and after that number out if any type of annuity option supplies sufficient benefits to warrant the expenses. I used the calculator on 5/26/2022 to see what an immediate annuity may payment for a solitary premium of $100,000 when the insured and partner are both 60 and live in Maryland.

Table of Contents

Latest Posts

How do I choose the right Retirement Income From Annuities for my needs?

What are the top Secure Annuities providers in my area?

What should I know before buying an Deferred Annuities?

More

Latest Posts

How do I choose the right Retirement Income From Annuities for my needs?

What are the top Secure Annuities providers in my area?

What should I know before buying an Deferred Annuities?